Convenience is Key With Mobile Banking

Check account balances and transactions, deposit checks1, sign up for balance alerts, view your statements, and track spending and budgets with Money Management.

Submit a loan application, accept your preapproved loan offers2, and sign up for Skip A Payment (if eligible).

Load Cash Back Offers to your Arizona Financial Visa® debit card and earn rewards on everyday purchases.

1. To qualify for mobile deposit: (1) Account open at least 90 days (contact us for exceptions); (2) Deposits made to account totaling $250 or more within last 30 days or $500+ on deposit in account; and (3) Valid address, phone number and SSN/TIN on file. Specialty accounts (court-ordered, rep payee, etc.) do not qualify. Other conditions and restrictions may apply.

2. On approved credit. All members may not qualify.

Bank from anywhere with Mobile Banking

Apply for loans, pay bills, deposit checks and so much more!

-

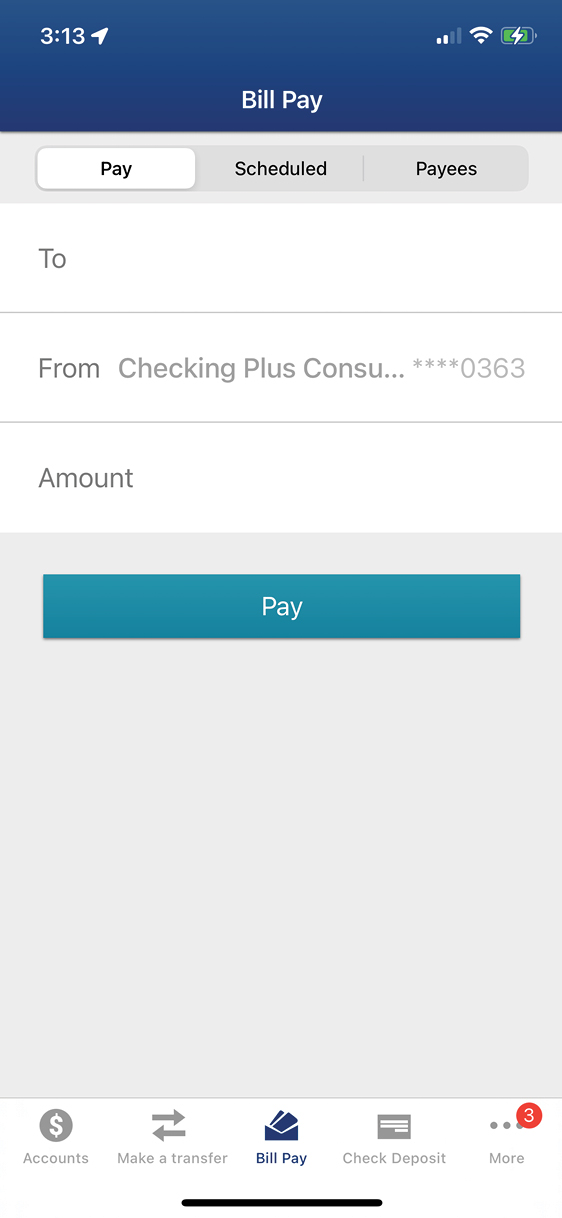

Pay Bills

Manage your bills and set up one-time or recurring payments through Bill Pay.

-

Apply for a Loan

When you need money but you don't have the time to sit in front of a computer, complete your loan application on-the-go using our mobile app.

-

Deposit a Check

Sometimes life moves too fast to sit in a drive-thru line. Deposit your checks from anywhere!

-

Schedule an Appointment

Schedule an appointment with a branch representative using our mobile app so you can get the help you need fast!

Free Financial Management Tools

Enjoy easy access to your financial picture with Money Management inside Arizona Financial's mobile app.

- Keep track of all of your accounts in one place (even accounts from other places you bank!)

- Review automatically categorized transactions to easily track your spending habits

- Consider a suggested budget based on your spending and deposit habits

To register, log in to the app, tap on "Check Deposit," and review and accept the agreement. We'll process your registration within one business day and send you a confirmation email.

In order to have your mobile deposit approved, you must sign the back of your check and underneath the signature write your account number and "For mobile deposit – Arizona Financial."

Arizona Financial has a maximum limit of $2,500 per check; $5,000 per day; $10,000 per rolling 30 day period (lower limits for minors). Our daily limits may be increased if you qualify. Please call 602-683-1000 for assistance.

Once you have registered, select "Check Deposit" from the app menu and choose the account you want to receive the deposit. Enter the check amount and follow the instructions to take pictures of your check. Tap "Deposit" and view your confirmation.

3. To qualify for mobile deposit: (1) Account open at least 90 days (contact us for exceptions); (2) Deposits made to account totaling $250 or more within last 30 days or $500+ on deposit in account; and (3) Valid address, phone number and SSN/TIN on file. Specialty accounts (court-ordered, rep payee, etc.) do not qualify. Other conditions and restrictions may apply.

Don't Forget to Use Your Mobile Wallet

Leave your wallet in your pocket or purse - your mobile wallet makes storing your Arizona Financial Visa debit card and credit card easy!

- It's Safe: It’s a safer way to pay because your card number is never shared with the merchant.

- It's Simple: Swipe up on your phone's home screen or tap to activate the wallet feature.

- It's Everywhere: Available at millions of merchants nationwide.

- It's Easy to Get Started: Navigate to your Wallet app on your device to add Arizona Financial's debit and credit card.

Mobile Banking Resources

Ways To Protect Your Information Online

With data breaches and identity theft on the rise, you can help protect your information online with a little common sense (like limiting how much personal information you share on social media!) and by following a few basic tips.

Read MoreScams And Risks Of Using Cash Apps

Cash transfer apps are making it easier than ever to quickly transfer funds to a friend or split a lunch tab. But if you get scammed or have an issue like sending a payment to the wrong person or sending the wrong amount, there’s little to no protection.

Read MoreDo's And Don’ts To Protect Yourself From Scams

With scams on the rise and countless scams out there – like check scams, job scams, loan scams, and romance scams, here are some tips to help you protect your accounts and information from scams and identity theft.

Read MoreFrequently Asked Questions

How do I log in to mobile banking for the first time?

If you're already signed up for online banking, you'll use the same username and password for mobile banking. Otherwise, follow these instructions.

Temporary username:

- Your temporary username is your member number. This number can be found at the top left corner of the Membership Application, which is included within your new account documents.

- If you opened your account online, you also received a welcome email that includes the account number. Your member number can be identified by excluding the first two zeros of the account number in the email.

- If your banker instructed you to use our Business Banking platform, your temporary username was emailed to you.

- Your temporary password/registration code was provided by the banker who opened the account.

- If you opened your account online, this information was sent to you by email.

- If your banker instructed you to use our Business Banking platform, your temporary username was emailed to you.

- We're here to help! Contact us and we'll be happy to help if you're unable to locate your temporary username or password/registration code.

How do I locate my account number in mobile banking?

This printed tutorial will demonstrate how to locate your account number within mobile banking.

- The ACH and MICR numbers displayed can be used to order checks or establish direct deposit or electronic withdrawals. (A MICR number is the account number included at the bottom of your checks).

- Arizona Financial's routing number is 322172797.

- To obtain a direct deposit form with a voided check, please log in to online banking from a desktop or laptop device and complete the steps below. If your banker instructed you to use our Business Banking options, please contact us at 602-683-1000 for assistance obtaining a form.

- Once you're logged in, click on the Additional Services tab in the blue bar at the top of the page and select "Direct Deposit Form." Please use the drop-down options available on the image of the check to indicate if you'd like the check to display information for your checking or savings account.

What are the requirements to qualify for mobile deposit?

To qualify for mobile deposit:

- The account must be open at least 90 days. Please contact us at 602-683-1088 if you'd like us to consider an exception.

- There must have been deposits made to the account totaling $250 or more within last 30 days, or $500 or more on deposit in the account.

- A savings or checking account, in addition to the Membership Share, must be open on the account.

- A valid address, phone number and SSN/TIN must be on file.

- Some specialty accounts, such as court-ordered or representative payee, do not qualify for mobile deposit. Other conditions and restrictions may apply.

Additional information:

- We're unable to accept a payment directly to a loan through mobile deposit and must first post funds to the savings or checking account.

- When depositing a check payable to multiple individuals, please be sure that all individuals have signed the back of the check.

- The proper endorsement includes a signature, account/member number and "Mobile deposit - AZFCU."

- The credit union does not accept third-party checks. This is a check payable to someone who is not listed as an accountholder on the account funds are being deposited to.

- In the event a check exceeds your limit, please contact us and we'll be happy to discuss additional options.

How do I reset my password or retrieve my username for mobile banking?

Here is some other helpful information:

- If you're registering for the first time? Give our experts a call at 602-683-1088, Monday through Friday from 9 a.m. to 6 p.m. and we’ll be happy to help you obtain your registration code.

- You will use the same username and password for online banking and mobile banking.

- Members who have been instructed by their banker to use our business banking options will be able to reset a forgotten password using the recover credentials option, but will not be able to retrieve a username. For help with a username, please give our experts a call at 602-683-1088, Monday through Friday from 9 a.m. to 6 p.m.

We’re here to help with password resets 24 hours a day, 365 days a year! Contact us at 602-683-1000 for assistance.