Are you ready to embark on unforgettable summer adventures? Whether you're dreaming of cruising on the open water or exploring the great outdoors in an RV, ATV, or UTV, Arizona Financial has you covered with our flexible financing options. Get ready to make waves and create lasting memories with our boat and recreational vehicle loans!

Boat loans for smooth sailing

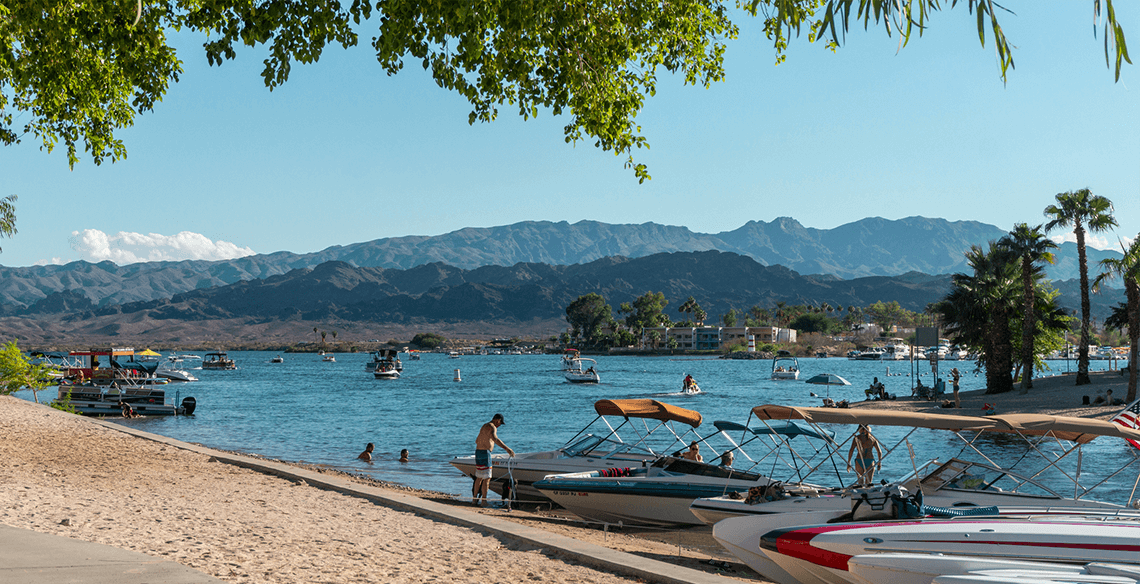

Picture yourself gliding across serene waters, the wind in your hair and the sun on your face. With Arizona Financial's boat loans, that dream can become a reality.

Whether you're purchasing a new or used boat, we offer competitive interest rates and flexible terms to fit your budget. Plus, our straightforward application process makes securing financing a breeze.

Summer activities await!

With your boat loan from Arizona Financial, the possibilities for summer fun are endless. Spend weekends fishing on the lake, host unforgettable gatherings with friends and family, or simply relax and soak up the sun. From water skiing to sunset cruises, there's something for everyone to enjoy on the water.

RV, ATV, UTV loans

If you prefer land-based adventures, our RV, ATV, and UTV loans can help you make the most of the great outdoors. Explore national parks, go off-roading in the desert, or embark on a cross-country road trip in the comfort of your own RV.

Whatever your summer plans may entail, Arizona Financial is here to help you make them a reality.

Explore your options

Interested in financing an RV, ATV, or UTV? Visit our RV loan information page to discover more about our flexible financing options and competitive rates.

How are these loans different?

Boat loans and RV (recreational vehicle) loans are similar to other types of loans, but they are tailored specifically for purchasing boats and RVs. Here's how they typically work:

- Application process: Just like any other loan, you apply for a boat or RV loan through a bank, credit union, or specialized lender. The application process involves providing information about your income, employment, credit history, and the details of the boat or RV you intend to purchase.

- Loan approval: The lender will review your application, credit score, and financial situation to determine whether to approve your loan and at what interest rate.

- Interest rates and terms: Interest rates for boat and RV loans can vary depending on factors like your credit score, the loan amount, the length of the loan term, and the age of the boat or RV. Generally, interest rates for boat and RV loans tend to be higher than those for traditional home or auto loans.

- Loan terms: Typically, boat and RV loans have terms ranging from 5 to 20 years but vary depending on the lender. Longer terms usually mean lower monthly payments but more interest paid over the life of the loan.

- Down payment: You may need to make a down payment when you purchase a boat or RV. The amount required can vary, but it's usually a percentage of the purchase price. A larger down payment can reduce the loan amount and monthly payments.

- Insurance: Lenders often require you to have insurance on the boat or RV to protect their investment. Insurance requirements can vary, but they typically include coverage for damage, theft, and liability.

And remember: always make sure you understand the terms and conditions of the loan before signing anything.

Don't let another summer pass you by without experiencing the thrill of the open water or the freedom of the open road. With Arizona Financial’s boat and recreational vehicle loans, you can set sail on your next adventure with confidence.

Ready to get started? Apply online today, give us a call at 602-683-1000 or stop by one of our branch locations for assistance. Let's make this summer one to remember!